Congratulations! You’ve been accepted to multiple colleges. Among the admission letters, from each college, you have also received a financial aid award letter detailing the total amount of financial assistance the school will offer to help fund your education. The next step is to Compare School Financial Aid Offers to determine which college is the most affordable. Because financial aid award letters all look different, it can be difficult to compare apples to apples. It may be helpful to familiarize yourself with this Glossary of Terms for Financial Aid Offers provided by NASFAA (National Association of Student Financial Aid Administrators).

Items to consider when comparing costs include the college’s cost of attendance and the amount of awarded financial aid. A college’s cost of attendance includes not only costs billed directly by the school (such as tuition and fees) but also costs indirectly associated with attending college (such as books, travel expenses, and personal expenses). If the cost of attendance is not listed on an award letter, ask the school’s financial aid office for this information. Awarded financial aid might include gift aid (grants and scholarships) as well as self-help aid. Self-help aid may include student loans, which must be repaid, and Federal Work-Study which is money earned through work.

To calculate the net price of each college subtract the number of grants and scholarships from its cost of attendance. It may be helpful to use an online financial aid calculator such as College Covered’s Award Letter Comparison Tool | College Covered or College Board’s Calculate Your Cost – BigFuture | College Board. Also, subtract any savings set aside to pay for college. The remaining amount, if any, will be your out-of-pocket cost to attend college for the year. For any remaining out-of-pocket expenses, consider applying for part-time employment or private scholarships. Such resources can limit the amount of borrowing needed to pay for college.

Pay close attention when calculating the net price. It is important to contact the financial aid office to ask questions if you are uncertain about any parts of your financial aid award. See Federal Student Aid’s Accepting Financial Aid to learn the best order in which to accept financial aid, including details about the differences between Federal Versus Private Loans, Subsidized and Unsubsidized Loans, and PLUS Loans. Once you have a good understanding of your awarded financial aid, follow the directions included in your award letter to accept your aid.

The net price must be recalculated each year because colleges’ cost of attendance and your awarded financial aid can change from year to year. As a general rule, the Consumer Financial Protection Bureau recommends that students limit total student debt to the expected starting annual salary after college graduation. CFPB’s financial aid offer tool, Your financial path to graduation, can assist in estimating how much you will owe when you leave college and whether or not you will be able to afford that debt.

For further reading:

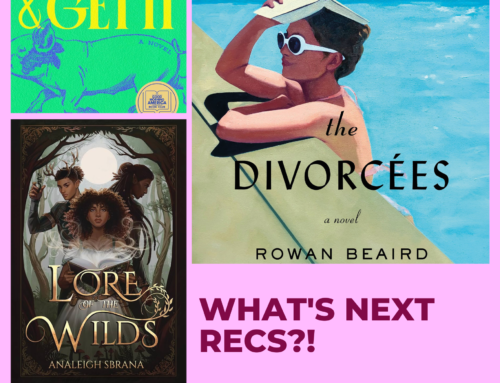

Charles County Public Library has many resources to assist with understanding and comparing financial aid awards. Search “paying for college” or “financial aid” in our COSMOS Catalog to see a list of available items. Here are a few titles to get you started.

The Price You Pay for College by Ron Leiber

The New York Times ‘Your Money’ personal finance columnist offers a deeply reported and emotionally honest approach to the biggest financial decision families will ever make: what to pay for college.

Paying for College 2022 by Kalman A. Chany

Financing a college education is a daunting task no matter what your circumstances. With line-by-line instructions for filling out the FAFSA and consumer-friendly advice to minimize college costs, Paying for College helps you take control of your experience and: Maximize your financial aid eligibility ; Learn how COVID-19 and the latest tax laws affect the financing of your college education ; Explore long- and short-term strategies to reduce college costs and avoid expensive mistakes ; Complete every question on the FAFSA and CSS Profile forms to your best advantage ; Compare aid offers and learn how to appeal them if necessary ; Plan strategically as a separated/divorced parent, blended family, or independent student.

The College Bound Organizer: The Ultimate Guide to Successful College Applications by Anna Costaras and Gail Liss

College bound high school students have one thing in common: the extraordinary number of details to keep track of. With standardized test-taking, school visits, essays to write and so many forms to fill out, it’s easy to feel overwhelmed. Packed with worksheets, lists, advice and invaluable insight, The college bound organizer will help you: understand what admissions officers are looking for in an applicant, Prevent the common mistakes often made on applications, Build your personal profile and write your resume, Plan your individualized testing schedule, Research colleges to identify the schools that are a good fit, Develop a balanced list of schools, Secure your letters of recommendation, Ace your college interviews, Complete and submit the best applications possible, Apply for financial aid and scholarships, Meet all your deadlines, and Help you make your final decision.

1001 Ways to Pay for College: Strategies to Maximize College Savings, Financial Aid, Scholarships and Grants by Gen and Kelly Tanabe

Completely revised with updated descriptions, contact information, websites, and available monies, this guide to financing higher education is the only resource students need to fund their pursuit of knowledge. Balancing detailed explanations with real-life examples and practical resources, the featured topics include finding and winning scholarships, requesting a reassessment from colleges for more financial aid, maximizing assistance from state and federal governments, taking advantage of educational tax breaks, and benefiting from government-subsidized student loans. Creative strategies-such as starting profitable dorm-room enterprises, trading tuition costs for volunteer service, and canceling debts with loan-repayment programs-help students find extra money when more traditional routes are exhausted. The provided tips are designed for students of all ages and levels and their parents.

Resources:

- Comparing School Financial Aid Offers

- Glossary of Terms for Financial Aid Offers

- Cost of Attendance

- Award Letter Comparison Tool | College Covered

- Calculate Your Cost – BigFuture | College Board

- Accepting Financial Aid

- Federal Versus Private Loans | Federal Student Aid

- Subsidized and Unsubsidized Loans | Federal Student Aid

- PLUS Loans | Federal Student Aid

- How much should I borrow in student loans? | Consumer Financial Protection Bureau

- Your financial path to graduation