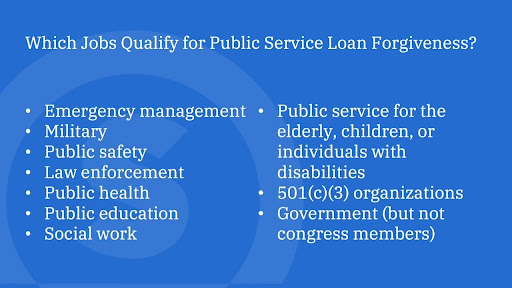

With all the controversy surrounding Student Loan forgiveness, it’s time for the facts to be shared with college graduates and students. Loan forgiveness programs have been around for some time. There are jobs that a graduate can go into that will allow them to make payments on their loans at a reduced rate. After making the required number of payments, the balance can be forgiven. Below is a short list of jobs that qualify for the PSLF, IBR and Teacher Loan Forgiveness programs. These are the three main types of student loan forgiveness programs.

Loan Forgiveness

As an employee in one of the public services fields, you can apply for an income-driven repayment plan. You do have to stay in the plan for 10 years to have your loan paid off. You can obtain further information from an article published on the SavingforCollege.com website: Which Jobs Qualify for Public Services Loan Forgiveness?

Public Student Loan Forgiveness (PSLF) How to apply

Applying for the PSLF program can be an involved process. Not all Loans qualify for the student loan forgiveness program. According to the savingforcollege.com website, “Private student loans, Federal Family Education Loans and Federal Perkin Loans are not Eligible for public service loan forgiveness.”

You can apply for loan consolidation or alternative repayment programs on your own, without paid assistance, through the U.S. Department of Education at www.studentloans.gov. You can also go to FedLoan Servicing or a private loan servicing company such as Higher Level Processing. Please make sure that you check the website that is handling your student loan for a list of approved companies they work with that can help you fill out and submit the PSLF form. You can also fill out the student aid form yourself and submit to your student loan agency.

Income Based Repayment

Income based repayment plans are available for all federal student loan borrowers. The exact repayment amounts will depend on your financial situation. Further information can be found at CreditRepair.com or on the Federal Student Aid website.

Teacher Loan Forgiveness

If you become a teacher after graduating, you may qualify for the teacher loan forgiveness program. High school math and science teachers and special education teachers in all education levels can potentially receive one-time forgiveness of $17,500 on their loans. All other teachers can potentially receive one-time forgiveness of $5,000. Further information can be found also in this article about Teacher Loan Forgiveness.

Once you’ve gotten approved for either the PSFL and/or the income driven repayment plan, remember that you are required to be on the plan and make 120 payments (or ten years of payments). The teacher loan forgiveness program plan does not require the 120 payments. Please check the details for this program. Visit the Federal Student Aid website for information on Income Driven Repayments and other options.

Private Student Loan Forgiveness

Unfortunately, there are few programs in place that will help you with Private Student Loans. Most student loan debt is held by the federal government, but quite a few people have gotten loans from private lenders. The options for these borrowers are very few and limited in availability. These types of loans and their forgiveness options are listed on the College Investor website.

1001 Ways to Pay for College

This book covers alternative ways to pay for college, and it includes a small section on student loan forgiveness.